41+ adding someone to title but not mortgage

Web A year later she got a second mortgage in the amount of 50000 from which moneys were used to add a garage to her house. The transfer of equity process can be complex however and there could be tax and legal implications if you make an error.

Can A Girlfriend S Name Be On A Deed And Not On The Mortgage Credere Law

In 2008 when the outstanding balance of those two loans was down to.

. The two terms deed and title are often used synonymously. Web If there is no mortgage then you dont necessarily need to use a conveyancing solicitor. The benefit to adding someones name to a title is that the home will legally transfer to that person after your death.

Web When you close on the mortgage loan the title company will secure the home in the name of the person who holds the mortgage. Web Loan modification If you owe money on your home youll need to seek a loan modification to add someone to your title. This process is similar to refinancing but is simpler and less expensive.

If you marry or add someone to your deed the person may agree to pay all or a portion of your home loan. Web The reason why most mortgage lenders do not allow a name to be added to a house deed but not be on a mortgage is that the mortgage lender does not want any party being able to claim ownership of the home without having the liability of the mortgage which is secured on the property. Web If you add someone to the deed and that person does not pay you for the interest and is not your spouse you must file a gift tax return.

This a very quick and practical way of acquiring property. Web Yes someone can be on the title and not the mortgage. Web Understand that adding someone to your deed changes you from a sole owner to a joint owner and should never be done without legal advise and direction.

If the value of the interest in your house is worth more than the annual gift tax exclusion which for the 2017 tax year is 14000 it will be 15000 for 2018. All of these parties will share some of the financial risk with youin other words theyll be on the hook for paying off the debt of your new mortgageexcept for a title holder. Should my wife be on the title.

The house deed is the physical document that is used to transfer title and thus proves who owns the house. Web The federal government assesses taxes or a reduction in the available estate tax exemption against any gift over 11000 made to any one person in a calendar year Grier said. Transfer of equity legal fees are inexpensive so most people prefer to use a solicitor.

Web As long as a new borrower is on title but not on mortgage and not on the note they are fine. I am in Ontario and Id like to know if its possible to put my spouses name on the title to the house but not on the mortgage. That means that they get the house deeded to them and just take over making the sellers payments.

Web Putting someone on the title to the house but not on the mortgage. Web By adding your name to the title but not to the mortgage he is giving you half ownership in the property without any responsibility for making the mortgage payments. Call Us Will Spouse On Title But Not on Mortgage Be Able To Qualify For Mortgage After Foreclosure.

If you add someone to your property it may be viewed as a gift of one-half the value of the property. Web When it comes to refinancing you can add a co-borrower a co-applicant a guarantor or a title holder. A person whose name is on a house deed has the title to that particular house.

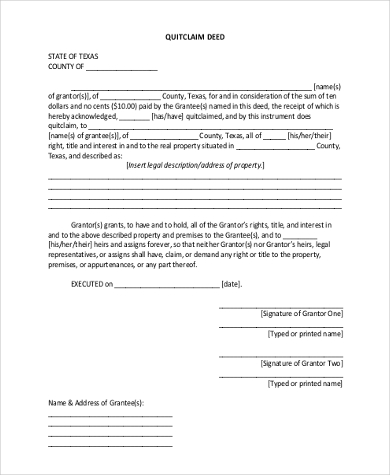

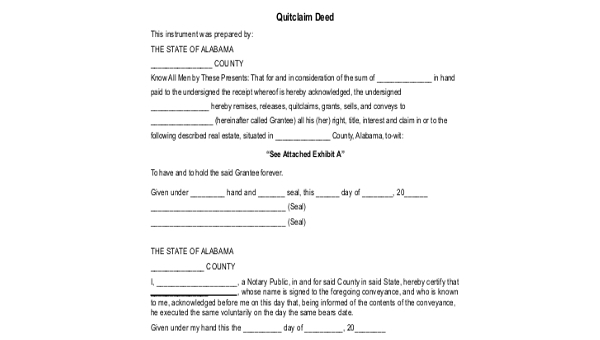

However if refinanced out with the intention of deceiving or planning on foreclosing on the home then it is a definite no-go. Web Using a quit claim deed is often the simplest method of bringing on another owner. Web You can add someone to the deed with a mortgage if you.

The process adds the other person to your title and also adds them to the loan policy on the home. Of course you will contribute equity and cash to pay the mortgage but you dont have any legal liability for this debt. Web If your name is on the deed but not the mortgage it means that you are an owner of the home but are not liable for the mortgage loan and the resulting payments.

If you default on the payments however the lender can still foreclose on the home despite that only one spouse is listed on the mortgage. The key factor however is to make sure you have lender approval. This is something that is often done with a spouse child or parent.

Web Investors often buy property by taking title subject to the existing mortgages. Is this doable or do I need to refinance my mortgage and go through the entire process to qualify. Web Yes adding someone to the title for your home without refinancing to include them on the mortgage is an option.

Web Instead you can add the person to your mortgage deed by contacting your title company and paying the required fee but certain situations may warrant adding a co-borrower to your mortgage loan. With the lenders approval however you may be able to add your spouse or any other person you wish to add.

41 Startup Terms And Metrics You Need To Know Stride Blog

1 Bhk Apartments Flats In Boisar Palghar 41 1 Bhk Apartments Flats For Sale In Boisar Palghar

7333 Miller Road Anacortes Wa 98221 Compass

Adding Someone To Your Real Estate Deed Know The Risks Deeds Com

Free 6 Sample Quitclaim Deed Forms In Pdf Ms Word

Pdf 7 3 Mb Gildemeister Interim Report 3rd Quarter 2012

The Iola Register June 3 2020 By Iola Register Issuu

The Real Estate Buyer S Guide 410 Gateway To The Smokies Nc By R Issuu

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Name On House Title Is Not On Mortgage Loan Lovetoknow

Full Article Subject Librarians Vs Collection Data How To Use Data To Visualize A Small Monograph Collection

Deed Vs Mortgage Name On Deed But Not On Mortgage Trust Will

Irq 0givbtmzm

Free Cover Letter 41 Examples Format Sample Examples

Name On Loan But Not On Title Is It Possible Youtube

Drs A

Free 7 Sample Quit Claim Deed Forms In Ms Word Pdf